Whispers of a Rebound: Fancy Color Diamond Market Poised for a Strong Second Half After Q2 2025 Dip

The world of fancy color diamonds, a realm where nature’s rarest masterpieces command astronomical prices, experienced a moment of quiet contemplation in the second quarter of 2025. According to the latest data from the esteemed Fancy Color Research Foundation (FCRF), a subtle cooling period saw overall prices dip for the second consecutive quarter. However, a deeper dive into the figures reveals a narrative not of decline, but of resilience and strategic realignment. Far from being a cause for alarm, the market is showing definitive signs of stabilization, with pockets of significant strength suggesting that the groundwork is being laid for a powerful rebound as the year progresses.

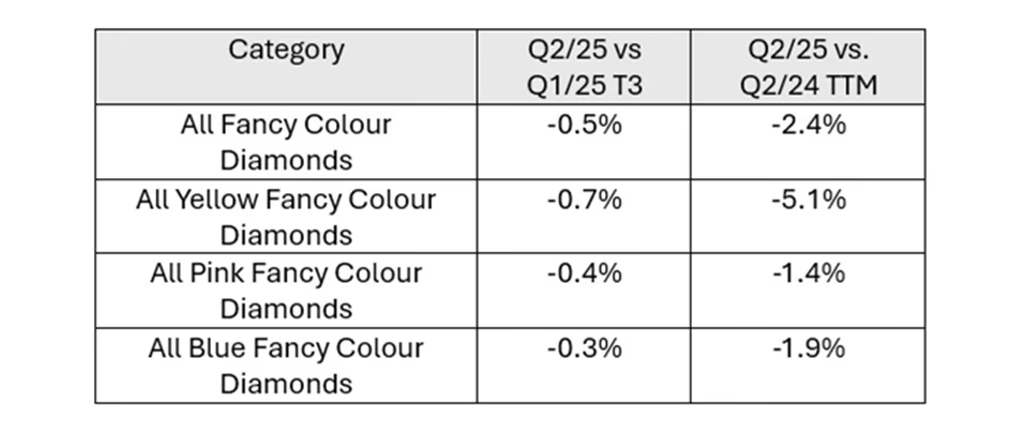

The headline figure from the Fancy Color Diamond Index (FCDI) indicated an overall price softening of 0.5% in Q2 2025. While this is a slight increase from the 0.3% dip recorded in the first quarter, it aligns with typical market behaviour, which often sees a slowdown ahead of the summer holiday season. Yet, beneath this top-level number, the market is a hive of activity. The FCRF report emphatically points to early signs of a market regaining its footing, with several key sub-categories showing remarkable strength and even price reversals, hinting at a sophisticated and targeted demand for the truly exceptional.

The Resilience of Rarity: Pinks and Blues Lead the Charge

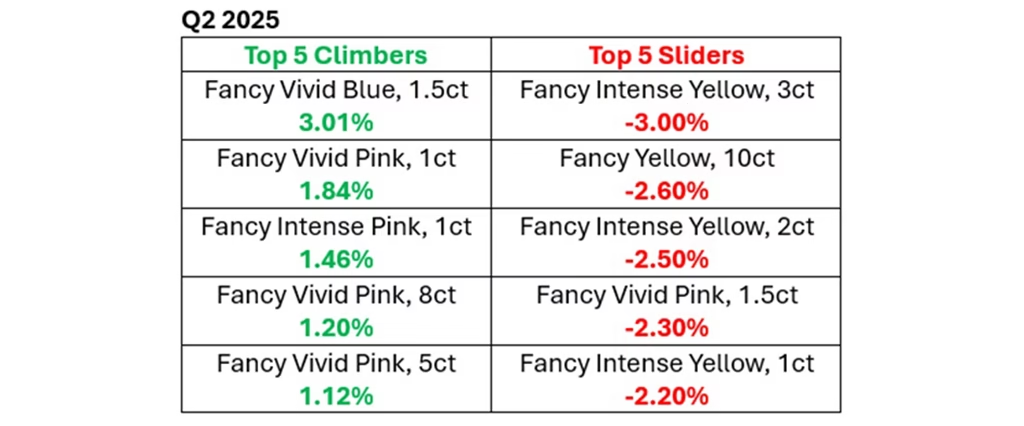

In the ultra-luxury space, value is dictated by scarcity, and no assets embody this principle more than fancy color diamonds. The Q2 data underscores this axiom, revealing that while the broader market paused for breath, the most sought-after and highly saturated stones continued to captivate serious collectors and investors. The true story of the quarter lies not in the overall dip, but in the outstanding performance of vivid pink and blue diamonds, which defied the trend and posted notable gains.

The Enduring Legacy of Pink Diamonds

Pink diamonds, arguably the most romantic and emotionally resonant of all colored stones, saw their category prices decrease by 0.4%, a marginal increase from the 0.1% dip in Q1. Over the last 12 months, the segment has seen a modest 1.4% decline. However, this general figure masks a crucial undercurrent of strength.

The most telling sign of renewed confidence came from the 1.5-carat fancy intense pink category, which rose by an impressive 1.0%. This is a significant turnaround from the previous quarter, where the same category had fallen by 1.8%. This reversal suggests that discerning buyers are re-entering the market, recognizing the long-term value proposition, especially in the wake of the permanent closure of the Argyle mine in Australia. The Argyle mine was the source of over 90% of the world’s high-quality pink diamonds, and its shuttering has created a finite, ever-dwindling supply that will inevitably drive prices upward over time. Collectors understand that every high-quality pink diamond on the market today is part of an irreplaceable legacy, and this fundamental supply constraint is a powerful buffer against short-term market fluctuations.

The Majestic Allure of Blue Diamonds

Blue diamonds, the geological miracles formed with traces of boron deep within the Earth’s mantle, demonstrated even greater stability. The overall blue diamond category was down a mere 0.3% in Q2, a notable improvement from the 0.5% drop in Q1. More importantly, the FCRF noted that multiple sub-categories within the blue diamond segment were either completely stable or recorded slight price increases.

Leading the pack was the breathtaking 1.5-carat fancy vivid blue, which surged by a remarkable 1.4%. This specific gain in the “vivid” category—the highest possible color saturation—is a testament to the unwavering demand for the absolute best. Blue diamonds are among the rarest substances on Earth, and a fancy vivid blue is the pinnacle of that rarity. These stones are not just gems; they are historical artifacts and tangible assets of the highest order. Their performance in Q2 sends a clear signal that for assets of this caliber, demand remains robust and largely insulated from wider market sentiment.

Understanding the Market Dynamics: Factors Behind the Figures

To fully appreciate the Q2 2025 data, one must look beyond the percentages and understand the forces shaping the market. The current climate is a complex interplay of supply constraints, collector psychology, and shifting economic tides.

The Psychology of Saturation: Why ‘Vivid’ Reigns Supreme

The consistent strength in the “vivid” pink and blue categories is no coincidence. The value of a fancy color diamond is determined primarily by its color, which is graded on three axes: hue (the actual color, e.g., pink or blue), tone (the lightness or darkness), and saturation (the intensity). The saturation scale runs from Faint, Very Light, Light, Fancy Light, Fancy, Fancy Intense, Fancy Deep, to Fancy Vivid.

“Fancy Vivid” represents the most intense, pure, and vibrant color saturation possible. These stones are exceptionally rare and visually spectacular, possessing a fire and life that sets them apart. In any market, but especially in a cautious one, collectors and investors gravitate towards the “best of the best.” These top-tier assets are seen as the most secure stores of value and the most likely to appreciate. The strong performance of vivid stones in Q2 confirms that the apex of the market is not just stable, but thriving.

Supply Constraints and the Specter of Scarcity

The FCRF explicitly noted that “inventory constraints due to the low availability of new rough on the market” are a key factor to watch. This is the single most important long-term driver for fancy color diamond prices. Unlike manufactured goods, the supply of natural diamonds is finite. The closure of major sources like the Argyle mine has permanently altered the supply-demand equation for pinks. Similarly, new discoveries of significant blue or other top-color diamonds are exceptionally rare events. This built-in scarcity provides a fundamental floor for prices and a powerful catalyst for future growth.

Expert Insights: A View from the Front Lines

Providing a perspective from the heart of the trade, Vishal Shah, Managing Director at the prominent diamond house Stargems, confirmed the underlying optimism. “Following a period of caution in the first half of the year, we are now seeing some consistent interest across the high-end colour diamond segment,” Shah stated.

His comments highlight several key trends that are shaping the market on the ground and point towards a strong finish to the year.

Regional Appetites and the Importance of Provenance

Shah elaborated on where this renewed interest is coming from: “Our clients – especially in Asia and the Middle East – are showing renewed appetite for vivid stones with strong provenance.”

This observation is critical. The luxury markets in Asia and the Middle East have shown remarkable resilience and a growing sophistication. High-net-worth individuals in these regions are increasingly looking to diversify their portfolios with hard assets, and rare diamonds are a perfect fit. They are portable, private, and hold immense value in a small package.

Furthermore, Shah’s mention of “strong provenance” is crucial. In today’s market, a diamond’s story is nearly as important as its physical characteristics. Provenance refers to the documented history of a stone—its origin, its previous owners, and its certifications from respected gemological laboratories like the GIA. A strong provenance provides buyers with confidence, authenticity, and a connection to the stone’s legacy, enhancing its desirability and investment-grade appeal.

The Investment Horizon: A Look Towards a Brighter Second Half

With the market stabilizing and elite stones showing strength, all eyes are on the second half of 2025. The FCRF itself suggests that the current stability “could mark the groundwork for a rebound around September.”

Anticipating a September Surge

Several factors support this optimistic outlook. Firstly, the summer slowdown will give way to the active autumn auction season, where major houses like Christie’s and Sotheby’s will present their finest offerings, often setting new price benchmarks. Secondly, as consumer confidence returns, pent-up demand is likely to be unleashed, especially in the lead-up to the holiday season. Finally, the ever-present reality of supply constraints will continue to exert upward pressure on prices. As available inventory is absorbed by discerning buyers, the scarcity of top-tier pinks and blues will become even more pronounced, likely fueling price appreciation.

As Vishal Shah concluded, “With summer now underway, the market feels stable and selectively active, setting the stage for a stronger close for the year.”

Conclusion: A Market Correcting, Not Crashing

The Q2 2025 report on the fancy color diamond market is a story of nuance and hidden strength. A cursory glance shows a slight dip, but a detailed analysis reveals a market that is healthy, rational, and poised for growth. The temporary softness in the broader categories is being offset by powerful demand for the rarest and most saturated stones, particularly vivid pinks and blues. This bifurcation shows a mature market where connoisseurs are making strategic acquisitions, focusing on long-term value over short-term trends. With unassailable supply constraints, renewed interest from key global markets, and the enduring allure of these natural wonders, the whispers of a Q2 dip are already being drowned out by the confident promise of a dazzling second half.